Understanding the Current Housing Market

Before making the decision to sell your home, it is vital to comprehend the prevailing trends in the housing market. The most notable shift is that homebuyers are acclimating to the present mortgage rates, regarding them as their new reality.

A Deep Dive into Mortgage Rates

To delve deeper into what’s been happening with mortgage rates recently, let’s look at some trend data. This data focuses on the 30-year fixed mortgage rate from Freddie Mac, starting from the previous October. Notably, these rates have maintained a consistent range between 6% and 7% for the last nine months.

While these numbers might seem somewhat static, it’s important to note that they are up significantly from previous years. This increase has had significant implications on buyer behavior and overall market dynamics, affecting both the supply and demand sides of the housing market.

The Impact of Mortgage Rates on Home Sales

According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), mortgage rates play a pivotal role in determining buyer demand and, in turn, home sales. Stable rates lead to stable home sales, he suggests. This steadiness has given rise to several consecutive months of consistent home sales, marking a positive trend in the market for sellers.

For sellers, the consistency in home sales signifies a steady stream of potential buyers. This group is not only maintaining its size but also actively purchasing homes, keeping the market robust and encouraging for those looking to sell.

How Mortgage Rates Influenced Demand

Mortgage rates have had a profound impact on the real estate market over the past year. When rates surged from roughly 3% to 7%, it shocked many potential homebuyers, leading to a pullback in buying activity. This increase, dramatic and unexpected, led many to reassess their home buying plans, with some deciding to wait out the surge in hopes of future decreases.

However, as time has passed, the initial shock of this hike has worn off. Buyers have grown accustomed to the higher rates, acknowledging that the record-low rates enjoyed in the past years have come to an end. According to Doug Duncan, SVP and Chief Economist at Fannie Mae, consumers are adapting to the expectation that higher mortgage rates are here to stay for the foreseeable future.

Consumer Sentiment and Future Buying Intentions

Consumer sentiment is a critical factor in predicting future market trends. A recent survey conducted by Freddie Mac has brought some interesting insights to light. According to the survey, 18% of respondents are likely to purchase a home within the next six months.

This is a significant figure, suggesting that nearly one in five people surveyed plan to buy a home in the near future. These potential buyers intend to remain active in the coming months, offering a robust pool of prospects for those considering selling their homes. This trend might have sellers optimistic about the level of activity they can expect in the market.

Beyond Mortgage Rates: Other Factors Influencing Buyer Demand

While mortgage rates undoubtedly play a crucial role in shaping the housing market, they aren’t the only factor at play. People move houses for a variety of reasons, many of which are independent of current mortgage rates.

Job relocations, changes in household size, upgrading or downsizing, and personal motivations like wanting to live closer to family or in a particular school district often drive decisions to move. These factors will always be present, ensuring a level of demand in the housing market that is relatively immune to fluctuations in mortgage rates.

As a seller, this knowledge should instill confidence. Regardless of where mortgage rates stand, there is a market for your house today. And judging by the trend, that demand is substantial as buyers grow accustomed to the current rates.

The New Normal: Buyers Adapting to Current Mortgage Rates

The way buyers perceive and react to mortgage rates is shifting. They are getting used to the new normal, realizing that the low rates of yesteryears are unlikely to return anytime soon. This acceptance is encouraging for sellers as it means a more predictable, less volatile market.

Steady rates are contributing to robust buyer demand and consistent home sales, all signs of a healthy real estate market.

Given the ever-changing nature of the housing market, expert guidance can make a significant difference. Local real estate agents can provide informed advice on how to best navigate the current market dynamics.

Real estate agents not only understand the broad market trends but also have a keen eye for local shifts and patterns. By leveraging their insights and expertise, sellers can position their homes to appeal to active buyers, ensuring that their properties get the right level of exposure.

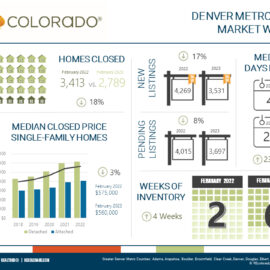

It is still a sellers market

In the grand scheme of things, current buyers are shifting their perspectives and adjusting their expectations. They are getting used to the idea of a higher normal when it comes to mortgage rates. This normalization is fostering a strong buyer demand and consistent home sales.

As a seller, tapping into this demand requires an understanding of these trends and a strategy that aligns with them. Connecting with a local real estate agent is an excellent step towards achieving this, getting your property on the market, and into the sights of active buyers.

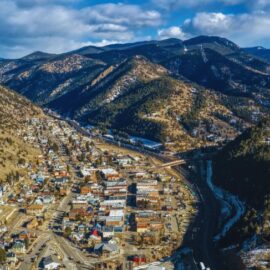

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida

Dan Skelly Real Estate

- 1 Understanding the Current Housing Market

- 2 A Deep Dive into Mortgage Rates

- 3 The Impact of Mortgage Rates on Home Sales

- 4 How Mortgage Rates Influenced Demand

- 5 Consumer Sentiment and Future Buying Intentions

- 6 Beyond Mortgage Rates: Other Factors Influencing Buyer Demand

- 7 The New Normal: Buyers Adapting to Current Mortgage Rates

- 8 Navigating the Market with a Real Estate Agent

- 9 It is still a sellers market