The real estate market in Colorado has been experiencing a surge in prices over the past few years. This is partly due to the state’s growing population and strong economy, which has led to increased demand for housing. However, the high prices are also putting a strain on many residents, especially those looking to buy their first home.

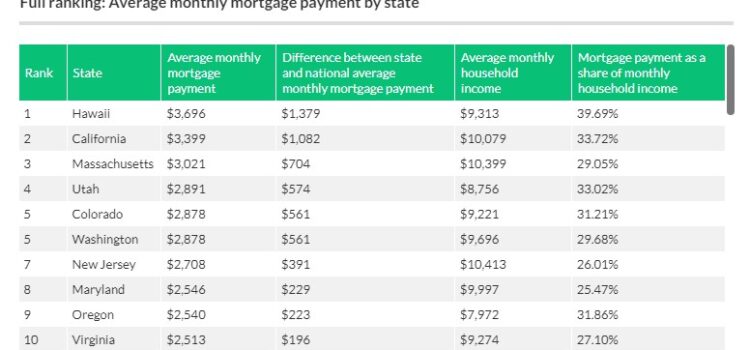

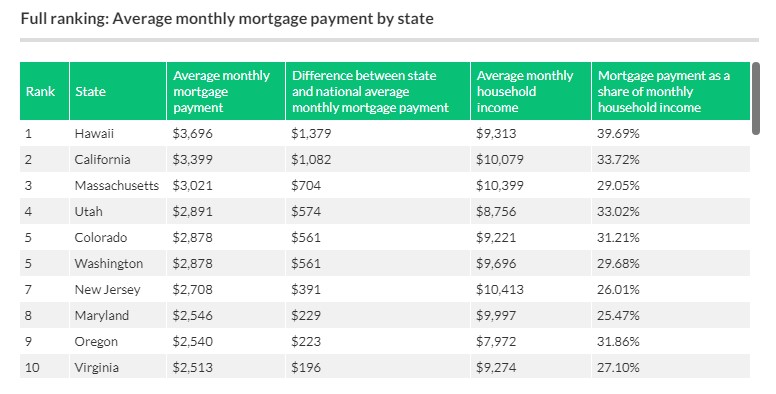

Colorado Ranks 5th in Mortgage Payments

According to recent data, Colorado ranks as the 5th most expensive state in the US for mortgage costs. The average monthly mortgage payment in Colorado is $2,878, which is $561 more than the national average. This means that residents of Colorado are spending a significant portion of their income on housing, with mortgage payments accounting for 31.21% of monthly household income on average.

Despite the high costs, many people are still drawn to Colorado for its beautiful natural scenery, outdoor recreational opportunities, and thriving urban areas. As a result, the demand for housing continues to rise, which is driving up prices even further.

However, there are some signs that the market may be cooling off slightly. While prices are still high, the rate of increase has slowed down in recent months. Additionally, the COVID-19 pandemic has had a significant impact on the real estate market, with many people opting to move away from urban areas and towards more rural locations.

Overall, the real estate market in Colorado is a complex and dynamic environment, with high prices, strong demand, and shifting trends. While it may be challenging for some residents to afford a home in this market, there are still opportunities for those willing to navigate the landscape and make strategic investments.

Colorado is a state known for its stunning natural beauty, outdoor recreation opportunities, and booming economy. With a population of over 5.8 million people, it’s no surprise that Colorado’s real estate market is competitive and dynamic. Whether you’re a first-time homebuyer or a seasoned real estate investor, understanding mortgage costs in Colorado is essential to making informed decisions about your next property purchase.

Mortgage Costs in Colorado: An Overview

According to a recent report by Bankrate, Colorado ranks as the fifth most expensive state in the country for mortgage payments. The average monthly mortgage payment in Colorado is $2,878, which is $561 higher than the national average. This translates to an annual difference of $6,732, which can add up significantly over the life of a 30-year mortgage.

One factor that contributes to higher mortgage costs in Colorado is the state’s hot real estate market. Home prices have been steadily rising in Colorado, driven by factors such as low inventory, strong demand, and an influx of out-of-state buyers. According to Zillow, the median home value in Colorado is currently $513,000, which is 20% higher than the national average.

Another factor that impacts mortgage costs in Colorado is interest rates. While interest rates have been historically low in recent years, they have been gradually rising.

Affordability Challenges in Colorado

The higher mortgage costs in Colorado can present challenges for homebuyers, particularly those with lower incomes or limited financial resources. According to the Bankrate report, the average monthly household income in Colorado is $9,221, which means that the average mortgage payment represents 31.21% of a household’s income.

This percentage is higher than the recommended maximum of 28%, which means that many Colorado residents may be stretching their budgets to afford a home. This can lead to financial stress, and in some cases, may result in delinquency or default on mortgage payments.

Another challenge in Colorado’s real estate market is the low inventory of affordable homes. Many of the homes for sale in Colorado are priced well above the national average, which can make it difficult for lower-income families to find a home within their budget. In addition, the high demand for homes in Colorado can lead to bidding wars and multiple offers, which can drive up prices and make it even more difficult for some buyers to compete.

Despite the challenges, there are steps that homebuyers can take to navigate Colorado’s real estate market and find a home that fits their needs and budget. Here are some tips to keep in mind:

- Work with a local real estate agent: A knowledgeable and experienced real estate agent can provide valuable guidance on the local market, help you find affordable homes, and negotiate offers.

- Get pre-approved for a mortgage: Before you start shopping for a home, get pre-approved for a mortgage. This will give you a clear understanding of your budget and help you make more informed decisions.

- Consider alternative financing options: There are a variety of alternative financing options available, such as FHA loans and VA loans, that may be more affordable and accessible for some buyers.

- Be patient and persistent: Finding an affordable home in Colorado’s competitive market may take some time, so be patient and persistent in your search. Keep an open mind and consider homes in different neighborhoods or areas.

- Plan for unexpected expenses: In addition to your monthly mortgage payment, be sure to plan for unexpected expenses such as repairs, maintenance, and property upkeep.

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida