Why Current Housing Inventory Indicates No Market Crash Ahead

The memory of the 2008 housing market crash still lingers in the minds of many. However, the current state of the housing market is fundamentally different, and the data suggests that a crash is not imminent. Let’s delve into why today’s housing inventory is a strong indicator that the market is more stable than it was over a decade ago.

Limited Housing Supply: A Key Factor

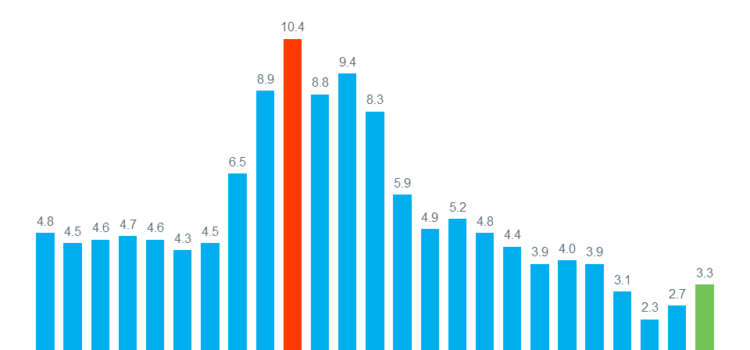

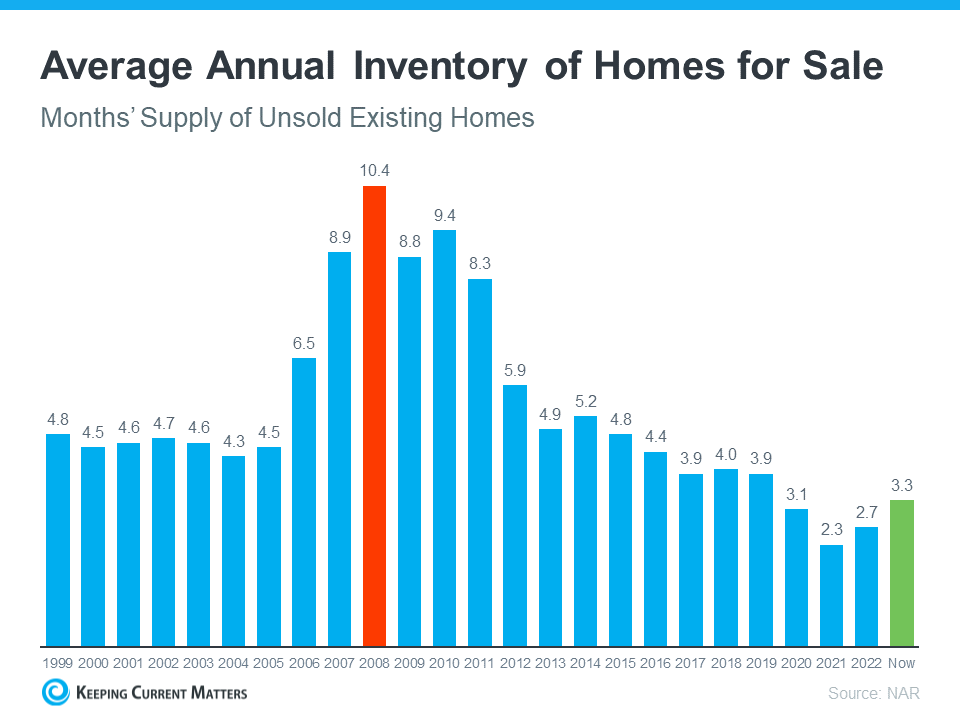

One of the most significant differences between now and 2008 is the availability of homes for sale. Unlike the oversupply that contributed to the 2008 crash, today’s market is characterized by an undersupply of homes. For a market crash to occur, there would need to be an excess of homes available, which is not the case at present.

Sources of Housing Supply

The housing supply comes from three primary avenues:

- Homeowners selling their properties

- Newly constructed homes

- Distressed properties, such as foreclosures or short sales

Homeowners Selling: A Closer Look

Although the housing supply has seen some growth compared to previous years, it remains below average. Current data indicates that there is only about a third of the available inventory today compared to 2008. This scarcity means that home values are unlikely to plummet, as there are not enough homes on the market to trigger a crash.

The Role of Newly Built Homes

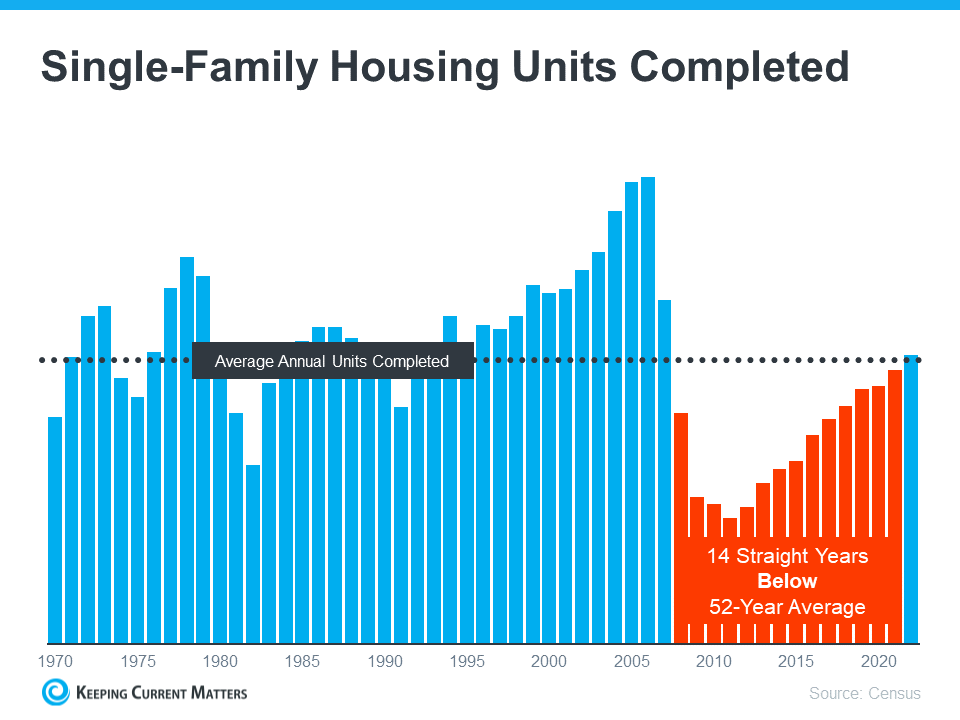

There has been much discussion about the surge in newly built homes. However, this should not be a cause for concern. Data shows that there has been a 14-year underbuilding trend, contributing to the current low inventory. While construction is picking up, it is unlikely to result in an oversupply due to the existing deficit.

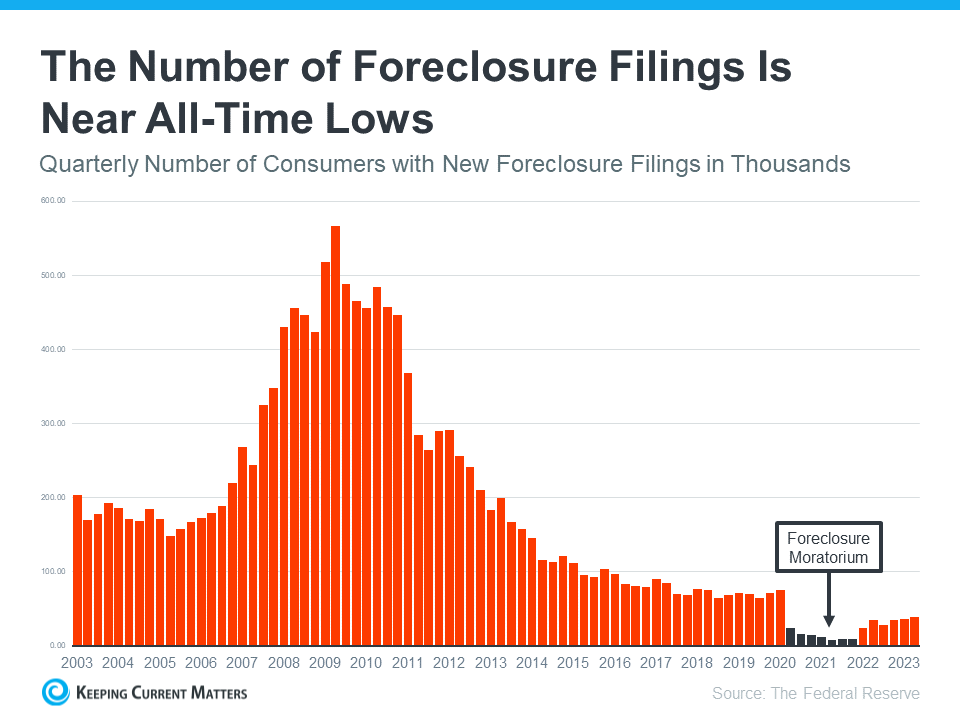

Distressed Properties: A Diminished Threat

The last significant source of housing inventory is distressed properties, including foreclosures and short sales. Unlike the 2008 crisis, where lax lending standards led to a flood of foreclosures, today’s lending criteria are much stricter. This has resulted in fewer foreclosures and a more stable market. Additionally, programs like loan forbearance have given homeowners more options to avoid foreclosure, further stabilizing the market.

What This Means for Buyers and Sellers

The current lack of inventory means that home prices are unlikely to drop significantly. According to Bankrate, the ongoing scarcity of homes indicates that a market crash is not on the horizon. Buyer demand remains strong, further supporting the stability of the housing market.

Stability Ahead

The current housing inventory levels are a strong indicator that a market crash akin to 2008 is not looming. With limited supply, stricter lending standards, and strong buyer demand, the market appears to be on solid ground for the foreseeable future.

For more insights into the housing market, especially in Evergreen, Colorado, visit Orson Hill Realty or for Florida real estate, check out Platinum Real Estate.

Would you like to know more? Feel free to contact us.

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida

Dan Skelly Real Estate