A Comprehensive Analysis of Real Estate Market Trends: June 2022 to May 2023

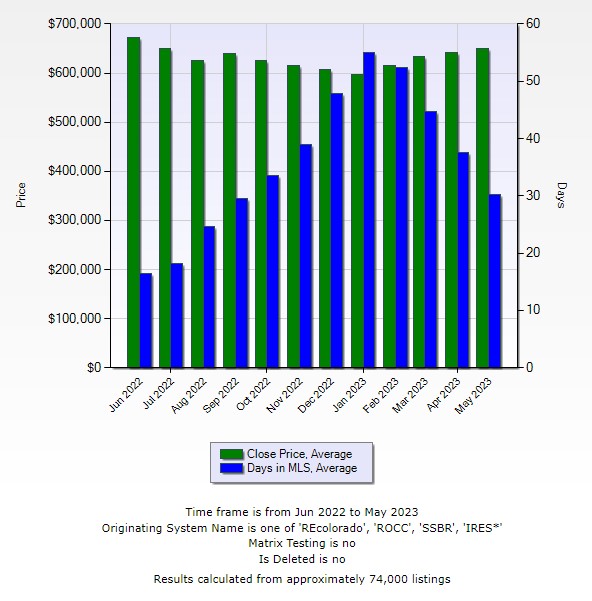

The real estate market is a complex and multifaceted entity, with its ebbs and flows influenced by a ton of factors. To just make a comment “The market is going to crash” without supplying data is really just talking about things you don’t understand. I mean seriously look at this chart. It is a textbook example of what I have been saying for a year now. If you were taking an econ class and the prof asked you to create a fake chart that shows a real estate market cycle this chart would be an A+. Unfortionatly for buyers they had a very, very short buyer market part of the cycle this time. (again, as I predicted). In this comprehensive blog post, we will delve deep into the data from June 2022 to May 2023, examining the average closing prices and the average number of days properties spent on the Multiple Listing Service (MLS). This analysis aims to provide a detailed understanding of the market trends during this period and shed light on the opportunities and challenges that potential buyers and sellers may have encountered.

This analysis is based on a robust dataset of approximately 74,000 listings, sourced from various originating systems, including ‘REcolorado’, ‘ROCC’, ‘SSBR’, and ‘IRES*’. The integrity of the data used in this analysis is of utmost importance. Therefore, it’s important to note that all data has undergone rigorous matrix testing to ensure its accuracy, and any deleted entries have been meticulously excluded from the analysis.

A Deep Dive into Average Closing Prices

The year kicked off with a robust average closing price of $673,258 in June 2022. This figure represents the culmination of various factors, including the demand and supply dynamics, the overall economic climate, and the specific characteristics of the properties sold during this period.

However, as we moved into the second half of 2022, the market began to show signs of cooling off. The average closing price experienced a steady decline, reaching a low of $596,025 in January 2023. This downward trend could be attributed to a variety of factors. Seasonal variations often play a role in real estate market trends, with the winter months typically seeing a slowdown in activity. Additionally, broader economic factors and market dynamics could have contributed to this trend.

Despite this downturn, potential buyers should not be disheartened. The real estate market, much like other economic markets, is cyclical in nature. Following the dip in January 2023, the market began to show signs of recovery. The average closing price started to climb, reaching $615,177 in February 2023. This upward trend continued, with the average closing price hitting $650,960 by May 2023. This resurgence could be indicative of increased buyer confidence, improved economic conditions, and a return to market stability.

Unpacking the Average Days in MLS

Turning our attention to the average number of days properties spent on the MLS, the data paints an interesting picture of market activity during this period. In June 2022, properties spent an average of 16 days on the MLS. This relatively short duration suggests a fast-paced market, with properties being snapped up quickly by eager buyers.

However, as we progressed through 2022, this pace began to slow. The average number of days on the MLS steadily increased, peaking at 55 days in January 2023. This increase suggests a slower market, with properties taking longer to sell. This could be due to a variety of factors, including changes in buyer behavior, market saturation, or economic uncertainty.

Nevertheless, the market demonstrated its resilience once again in February 2023. The average number of days on the MLS began to decrease, dropping to 30 days by May 2023. This decrease suggests a return to increased market activity and demand, with properties selling faster.

The Implications for Buyers and Sellers

The trends observed during this period have significant implications for both buyers and sellers. For buyers, the dip in average closing prices in the latter half of 2022 may have represented an opportunity to enter the market at a more affordable price point. However, the increase in the average number of days on the MLS during this period suggests that buyers may have been more cautious, taking their time to make decisions and negotiate deals.

However, as the market began to rebound in early 2023, some buyers may have found themselves in a challenging position. Those who were waiting for the bottom of the market may have missed their opportunity as prices began to rise again. This highlights the importance of staying informed about market trends and being ready to act when the right opportunity presents itself.

For sellers, the trends during this period presented their own set of challenges and opportunities. The decrease in average closing prices in the latter half of 2022 may have been a cause for concern. However, sellers who were able to weather this period may have been rewarded with higher prices as the market rebounded in 2023.

The increase in the average number of days on the MLS may have required sellers to be more patient and flexible. However, as the market picked up speed in 2023, sellers may have found that their properties were selling faster.

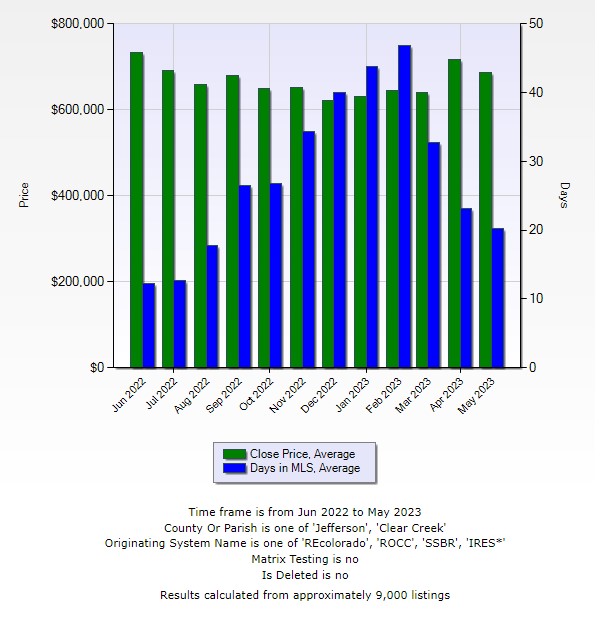

This is a chart of the Denver Foothills. You will see the same type of situation for this area as well….

The real estate market from June 2022 to May 2023 demonstrated the cyclical nature of the industry. Despite the downward trend in the latter half of 2022, the market showed resilience and adaptability, bouncing back in the first half of 2023.

However, this analysis also highlights the challenges that buyers and sellers can face when trying to time the market. The real estate market can be unpredictable, and trying to buy at the bottom or sell at the top can be a risky strategy. Instead, potential buyers and sellers should focus on their individual circumstances and goals.

If you’re a buyer, consider factors such as your budget, your housing needs, and your long-term plans. If you’re a seller, consider your timeline, your financial goals, and the current condition of your property.

While this data provides a snapshot of the market during this period, real estate trends can be influenced by a variety of factors. Therefore, potential buyers and sellers should always conduct thorough research and consider seeking professional advice when navigating the real estate market.

The real estate market is a dynamic and complex entity, with trends that can shift based on a multitude of factors. By staying informed and understanding these trends, buyers and sellers can make more informed decisions and navigate the market with confidence. Stay tuned for more insights and updates on the real estate market. Happy house hunting and selling!

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida