How Rising Interest Rates Impact Your Home Buying Power: Tips for Buyers

Buying a home is one of the biggest financial decisions that most people make in their lifetime. Interest rates play a major role in determining the affordability of a home, and rising interest rates can have a significant impact on a buyer’s purchasing power. In this article, we will discuss the ways in which rising interest rates impact home buying power and offer tips for buyers to maintain or increase their buying power.

Impact of Rising Interest Rates

Interest rates for Home mortgages have been rising in recent years, and they are expected to continue to rise in the coming years. This can impact a buyer’s purchasing power in several ways:

- Affordability: Rising interest rates make homes more expensive, which can reduce the affordability of a home. For example, if a buyer could afford a monthly mortgage payment of $1,000 when interest rates were 3.5%, they would only be able to afford a monthly mortgage payment of $950 if interest rates rose to 4%.

- Budget: Rising interest rates can reduce the amount of money that buyers have available in their budget for a down payment or other expenses related to purchasing a home. For every $10,000 in a buyer’s budget, they can expect to lose $50 per month if interest rates rise by one percentage point.

- Competition: Rising interest rates can increase competition among buyers, making it more difficult to purchase a home in certain areas or at certain prices. This can reduce the amount of “wiggle room” that buyers have in their budgets, making it more difficult to negotiate a favorable purchase price.

Tips for Buyers

Despite the impact of rising interest rates, there are several things that buyers can do to maintain or increase their buying power:

- Refinance: If a buyer has a variable rate mortgage and interest rates have been increasing, they may be able to lower their monthly payment by refinancing. This can allow them to pay less per month in interest and spend more on the home itself. However, if interest rates continue to rise, refinancing may become more difficult or impossible.

- Research: Before making an offer on a home, buyers should research the market to find out what’s selling and what’s not. This can help them to negotiate a favorable purchase price and avoid overpaying for a home.

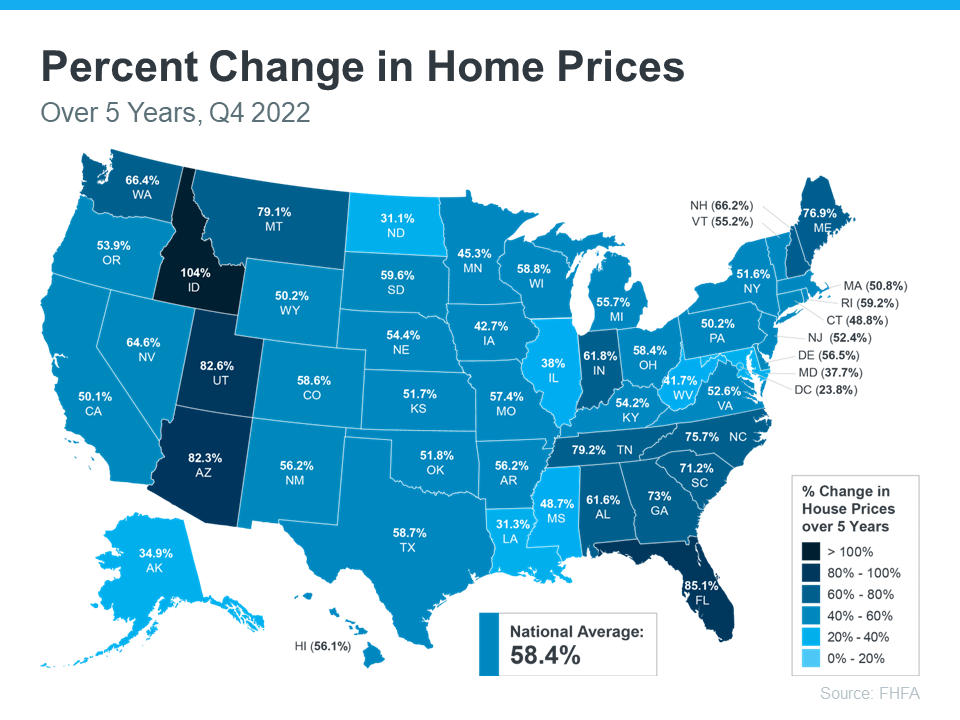

- Sell and then buy again: If a buyer is in the market for a new home, they may be tempted to sell their current residence and get into a brand-new place. However, depending on how much time has passed since purchasing their existing home, it could be worth less than what they paid for it. It may be better to hold onto the existing home and rent it out until the market improves.

- Improve credit score or down payment amount: Buyers can increase their buying power by improving their credit score or increasing their down payment amount. Lenders will often require a minimum down payment of around 5%, but increasing this amount can help buyers qualify for better interest rates and lower monthly payments.

Interest Rates and Buying a Home

Rising interest rates can have a significant impact on a buyer’s purchasing power, but there are several things that buyers can do to maintain or increase their buying power. By refinancing, researching the market, holding onto an existing home, and improving their credit score or down payment amount, buyers can increase their chances of purchasing a home that meets their needs and budget. While rising interest rates can make the home buying process more challenging, buyers who are prepared and informed can still find success in the housing market.

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida