Buying a home is one of the most significant financial decisions that you will make in your life. It’s a process that involves a lot of research, planning, and preparation. Fortunately, with the right knowledge and guidance, it doesn’t have to be a daunting task. In this article, we will break down the process of buying a home into simple steps, to help you navigate through the journey of becoming a homeowner.

Step 1: Qualify for a Home Loan

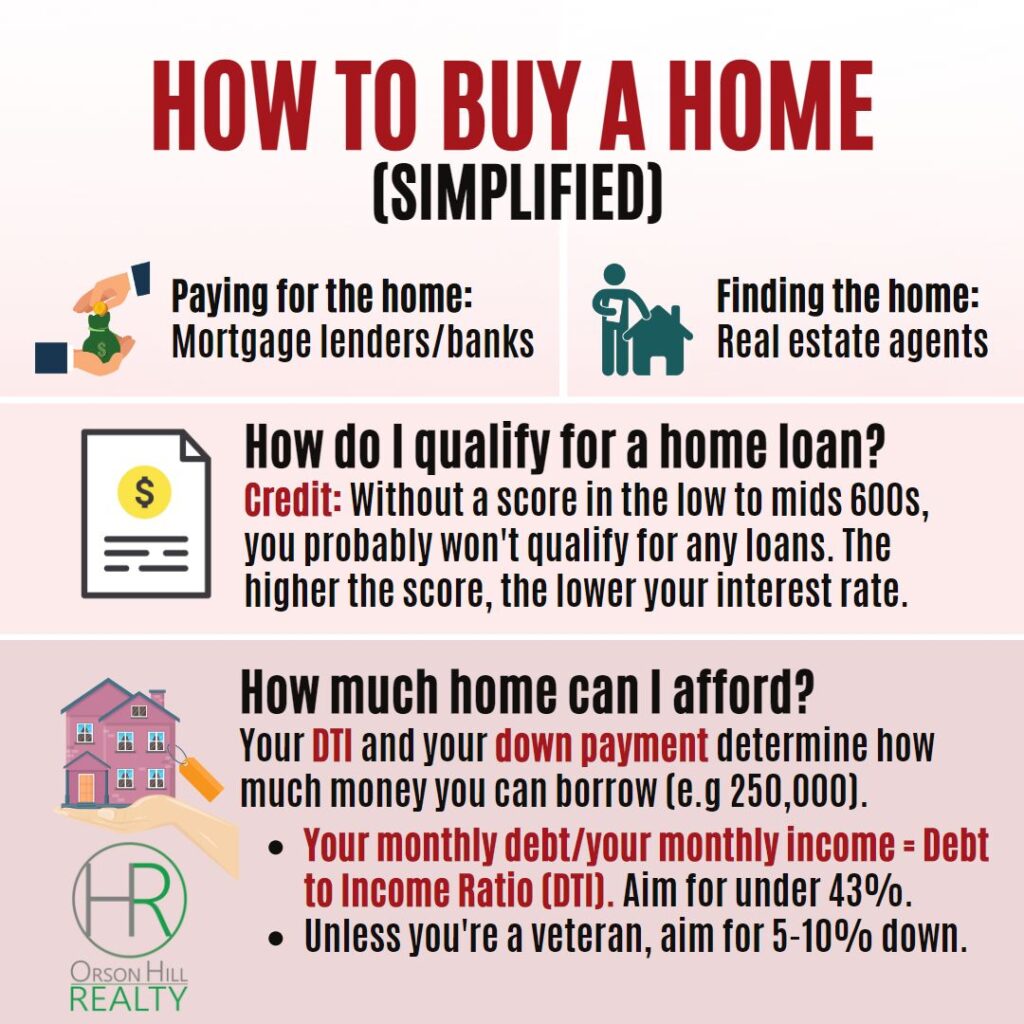

Before you start house hunting, it’s crucial to know how much home you can afford. To determine your purchasing power, you need to qualify for a home loan. Here are the factors that lenders consider when evaluating your eligibility:

Credit Score: Your credit score is a crucial factor in determining whether you qualify for a loan and what interest rate you will get. Without a score in the low to mid 600s, you probably won’t qualify for any loans. The higher your score, the lower your interest rate.

Debt-to-Income Ratio (DTI): Your DTI is the percentage of your monthly income that goes toward paying debts. Aim for a DTI under 43%. To calculate your DTI, divide your monthly debt payments by your gross monthly income.

Down Payment: Unless you’re a veteran, you should aim to put down 5-10% of the home’s purchase price. The more you can put down, the lower your monthly mortgage payments will be.

Step 2: Determine How Much Home You Can Afford

Once you know how much you can borrow, you need to determine how much home you can afford. This will depend on your DTI and your down payment. For example, if you qualify for a $250,000 loan and put down $25,000 (10%), your total budget would be $275,000.

Step 3: Paying for the Home

There are various ways to pay for a home. The most common option is through a mortgage from a bank or other mortgage lenders. To find the best mortgage for you, compare rates from multiple lenders, and consider different loan types, such as fixed-rate mortgages or adjustable-rate mortgages.

Another option is to pay cash for the home. This option is only available to those who have enough cash on hand to cover the purchase price. Keep in mind that paying cash for a home means that you won’t have a mortgage payment, but you’ll also lose out on the tax benefits of having a mortgage.

Step 4: Finding the Home

Once you know how much home you can afford, it’s time to start looking for your dream home. Here are a few ways to find your ideal property:

Real Estate Agents: A real estate agent can help you find homes that fit your budget and preferences. They can also negotiate with the seller on your behalf and guide you through the closing process.

Online Listings: There are numerous online platforms where you can search for homes in your desired location. You can use filters to narrow down your search by price, size, and other features.

Drive-By: If you’re looking for a specific neighborhood, you can drive or walk around the area to spot any “for sale” signs. This option is ideal if you’re looking for homes that aren’t listed online.

Final Thoughts

Buying a home is a significant financial commitment, but it can also be a rewarding experience. By following these steps, you’ll be better prepared to navigate the process and make an informed decision. Remember to do your research, compare options, and work with professionals who can guide you through the process.

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida