The Comprehensive Guide to Home Loans and Local Mortgage Lenders in Evergreen, Conifer, Golden, and Lakewood, Colorado

Local Home Mortgage Lenders

In the scenic locales of Evergreen, Conifer, Golden, and Lakewood, Colorado, the dream of owning a mountain home is a reality for many. However, securing a home loan for such a property can sometimes be a daunting task. This is where local mortgage lenders come into play, offering a deep understanding of the unique aspects of these properties, from wells and septic systems to easements and encroachments.

The Challenge with National Mortgage Companies

National mortgage companies, often unfamiliar with the intricacies of mountain homes, may hesitate to lend for properties in the Denver Foothills. Their apprehensions may stem from wildfire news, leading to misconceptions about the safety of these homes. However, the reality is that structural losses from wildfires are rare. This is where local mortgage lenders, with their nuanced understanding of the region, become invaluable.

The Advantage of Local Mortgage Lenders

Local mortgage lenders, based in Denver, Evergreen, Conifer, Golden, and the Denver Foothills, are well-versed in the specifics of mountain homes. Their expertise extends beyond just understanding the properties. They comprehend the broader market dynamics and are adept at navigating challenges that other mortgage companies may find perplexing.

Choosing a local mortgage lender is akin to selecting a dedicated real estate agent. They are driven, committed, and willing to go the extra mile for their clients. In a fast-paced market, having a lender who is available beyond the traditional 9-4, Monday to Thursday schedule can be a game-changer. A potential buyer may require a lender letter on a Sunday afternoon, and a local lender would be more likely to accommodate this request.

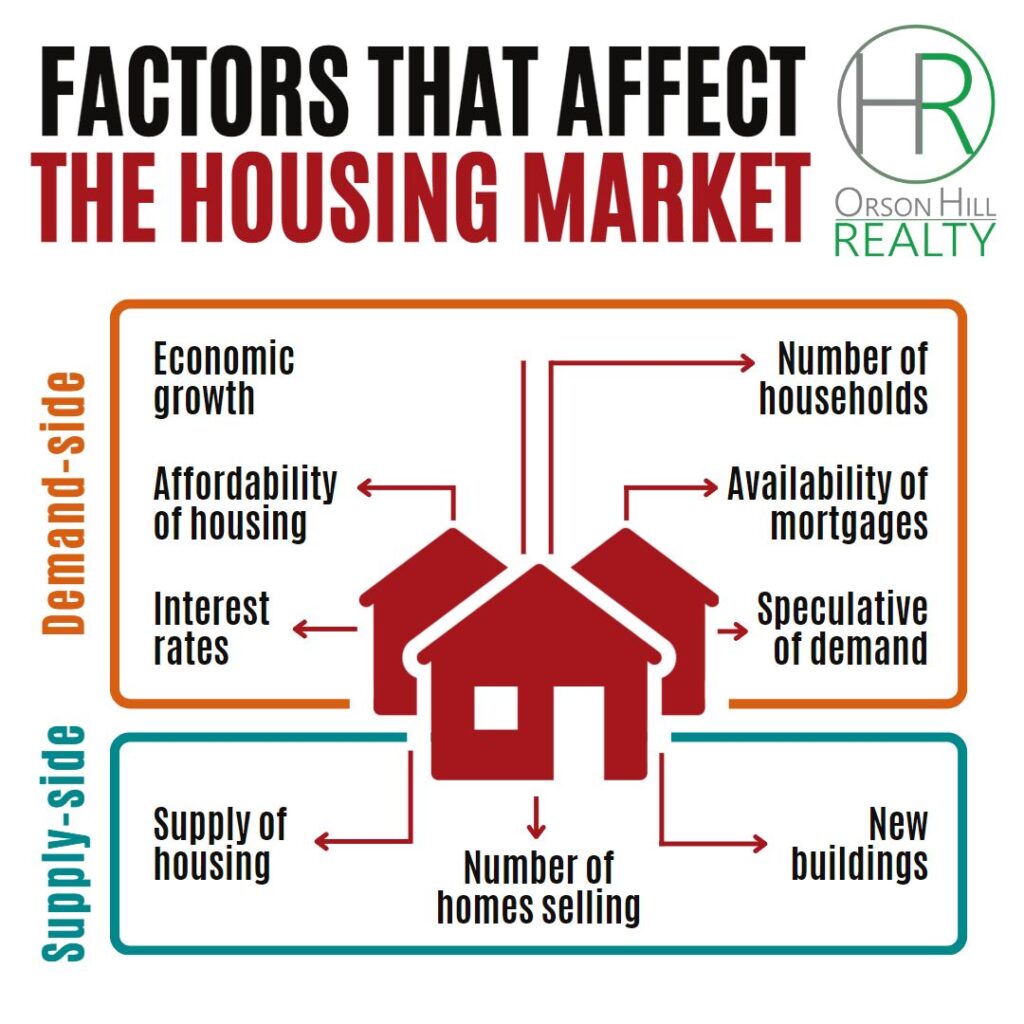

Mortgage Rates and Market Trends

Despite recent increases, mortgage rates remain relatively low compared to previous decades. In the 70s and 80s, a rate of 18% was considered a good mortgage rate. Now, rates are significantly lower, making it a great time to buy. By reaching out to local mortgage loan companies, potential buyers can get a sense of the rate they qualify for, which can help them determine their budget and monthly payments.

The Importance of Pre-Approval

Most home loan lenders can guide potential buyers through the pre-approval process with a quick phone call. This process is fast, straightforward, and free. It provides an estimate of what the buyer can afford and a basic idea of their monthly payments. In the competitive Colorado market, many real estate agents won’t even show homes until buyers have gone through the pre-approval process. Sellers are also more likely to consider offers that come with a pre-approval letter.

However, it’s important to note that a pre-approval letter isn’t a guarantee of a loan. It simply states that if the information provided is accurate and the buyer’s financial situation doesn’t change significantly, they are likely to get the loan.

Local Home Mortage Lenders

In the end, the journey to owning a mountain home in Evergreen, Conifer, Golden, or Lakewood, Colorado, can be made smoother with the help of local mortgage lenders. Their understanding of the local market, flexible working hours, and dedication to their clients make them an invaluable resource in the home buying process. With their assistance and the current low mortgage rates, now is a great time to consider buying a home in these beautiful Colorado locales.

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida