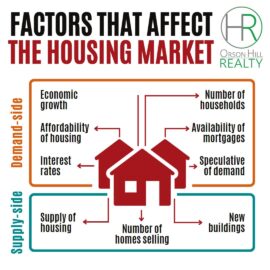

Mortgage interest rates are primarily affected by changes in the economy and monetary policies of the central banks in a country. Here are some factors that influence mortgage interest rates:

- Inflation: When inflation rises, the central bank may raise interest rates to bring inflation under control. Higher interest rates can increase the cost of borrowing, including mortgages.

- Economic growth: A strong economy typically means higher mortgage rates as more people are looking to borrow money to fund purchases like homes and businesses.

- Federal Reserve Policy: The Federal Reserve’s short-term interest rate impacts mortgage rates indirectly. When the Fed raises rates, it’s generally seen as a sign of a healthy economy, which can cause mortgage rates to rise.

- Consumer demand: If demand for homes and mortgages rise, it can push interest rates up. Conversely, if demand drops, interest rates could fall.

- Mortgage-backed securities: Mortgage lenders may package loans into mortgage-backed securities and sell them to investors. If these securities become riskier, for example, because of a high rate of defaults among borrowers, the market may demand a higher return on investment, causing mortgage interest rates to rise.

Overall, mortgage interest rates are influenced by various economic and financial factors, both nationally and globally. It is important to keep an eye on these factors when looking to purchase a new home or refinance your current one.

The bond market is a major determinant of interest rates. When a bond is issued, the yield or interest rate on the bond is determined by the market demand for that bond. If buyers are willing to pay a high price for the bond, the yield will be lower, and if buyers are less interested, the yield will be higher.

The bond market is influenced by a number of factors including inflation, economic growth, and monetary policy. When inflation is high, investors demand higher interest rates to compensate for the loss in purchasing power of their future earnings. Economic growth also impacts the bond market as investors are more willing to invest in bonds when the economy is growing, which can lead to lower interest rates.

Lastly, the monetary policy of central banks also plays a crucial role in determining bond yields. Central banks can influence the bond market by setting short-term interest rates, which can in turn impact longer-term bond yields. If central banks increase interest rates, the yield on newly issued bonds will also increase, and vice versa.

In summary, the bond market controls interest rates by determining the yield or return that investors demand for investing in bonds. This yield is influenced by a variety of factors including inflation, economic growth, and monetary policy.

The bond market works by setting the interest rates for long-term bonds, such as those issued by the government. Mortgage interest rates are also determined by these long-term rates, as mortgages are typically sold on the secondary market as mortgage-backed securities (MBS). If there is strong demand for long-term bonds, interest rates tend to go down, which can lead to lower mortgage rates. On the other hand, if there is weak demand, interest rates may go up, which can result in higher mortgage rates. Overall, the bond market plays a significant role in determining interest rates for mortgages.

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida