Colorado Housing Market Trends and the Possibility of a Crash

The Colorado housing market is currently undergoing a significant shift, with the median sale price falling by 1.8% in February 2023 year-over-year (YoY), and the number of homes sold dropping by 42.1%. As mortgage rates are at record highs in 20 years, with an average rate of 7.08%, sellers are reducing prices as homes stay on the market longer. With this shift in the market, buyers are finally gaining some market power. However, the Colorado housing market is now threatened by a similar instance of rising mortgage rates and the possibility of a recession. Thus, buyers and homeowners are asking a familiar question: When will the housing market crash in Colorado?

The pandemic caused a historic bull run in the housing market, leading to an increase in demand, supply chain disruptions, and supply shortages. The market’s sudden boom attracted real estate investors, flippers, and wholesalers, leading to an increase in home prices.

- Colorado Median Home Prices

Over a given period, the median house price is the middle sale price among all homes ranked from highest to lowest. The current housing market trend for 2022 shows that in September 2022, median home prices in Colorado were down by 1.8% compared to the previous year.

- Inventory

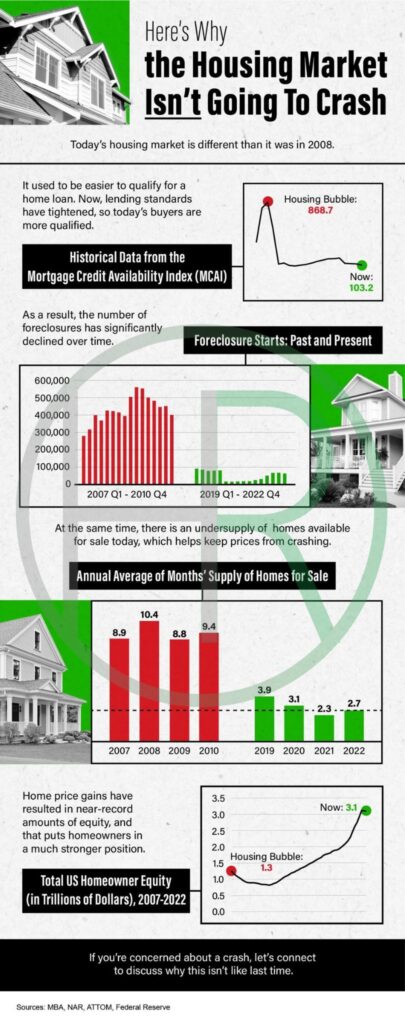

Inventory or homes for sale refers to the number of unsold residential and commercial real estate units. The current housing market trend for 2022 indicates that the supply of homes remains historically low, according to Lawrence Yun, NAR Chief Economist and Senior Vice President of Research. In September 2022, the inventory of unsold existing homes stood at 3.2 months.

- Homes Sold

The total number of properties sold during a specific period is known as homes sold. The current housing market trend for 2022 shows that fewer existing homes are selling nationwide. According to the September Redfin data, the seasonally adjusted total figure for 2022 decreased from 6.49 million in January to 5.1 million in September, bringing it to an all-time low of 42.1% compared to the previous year.

- Median Days on the Market

The median number of days property listings spend on the market in a given geography during the specified month is known as median days on the market. The current housing market trend for 2022 indicates that the median days on the market was 29 days, up 13 year-over-year.

- Mortgage Interest Rates

Lenders on a mortgage charge interest rates. These rates can be fixed, remaining constant over the loan term, or variable, fluctuating with a benchmark interest rate. The current housing market trend for 2022 shows that the national average 30-year fixed mortgage rate is at 6.1% and up 3.2 points year-over-year.

- Mortgage Application Rates

The number of mortgage applications received compared to the previous year is known as mortgage application rates. A mortgage application is a document submitted to the lender to buy real estate properties. The current housing market trend for 2022 shows that mortgage applications were 41% lower than a year ago.

- Foreclosures

Taking possession of a mortgaged property when the mortgagor fails to make mortgage payments is known as foreclosures. The current housing market trend for 2022 shows that 21,869 U.S. properties started the foreclosure process in September 2022, down 9% from the previous month but up 113% from a year ago.

Factors Affecting the Colorado Housing Market

Several parameters affect the real estate housing market Colorado prices. These factors are broadly categorized into four key segments:

Will the Colorado Housing Market Crash?

The Colorado housing market is undergoing a significant shift, with a 1.8% decrease in median sale prices and a 42.1% decrease in the number of homes sold in February 2023 compared to the previous year. Mortgage rates are at record highs, with rates of 7.08% – a situation that is leading to sellers reducing prices as homes stay on the market longer. As a result, buyers now have market power.

But, with the housing market in Colorado threatened by a similar instance of rising mortgage rates and the possibility of a recession, homeowners and buyers are asking the familiar question: when will the housing market crash in Colorado?

The COVID-19 pandemic caused a historic bull run in the housing market, with prices skyrocketing and demand exceeding supply. But as the pandemic subsides and the economy recovers, several factors are causing the market to shift.

Factors Affecting the Colorado Housing Market

Several parameters impact the real estate housing market in Colorado. These factors are broadly categorized into four key segments:

- Mortgage Interest Rates

Mortgage interest rates significantly impact the current Colorado real estate market. As mortgage rates increase, it becomes more expensive for buyers to obtain a mortgage, which reduces demand and, in turn, lowers home prices.

- Economy

The Colorado housing market varies depending on the overall health of the economy. Economic indicators include GDP, employment ratio, manufacturing activity, and the prices of goods. The country’s economic power directly affects the housing markets in the US.

- Demographics

Demographics define the composition of the population based on age, race, gender, income, migration patterns, and growth. Major changes in a country’s demographics can have a long-term impact on current Colorado housing market trends.

- Government Policies

Tax credits, deductions, and subsidies are some of the factors that can impact the demand for real estate. Understanding current government policies can help predict demand and supply and identify potentially false Colorado real estate market news.

What Is a Housing Market Bubble?

A housing market bubble refers to a steep incline in prices with increasing demand and limited supply. The demand continues to rise as more buyers enter the market, and investors like flippers and wholesalers also show up to snag investment properties. Ultimately, home prices reach unstable levels, making it unaffordable for the average or even above-average buyer.

What Causes a Housing Market Bubble?

A housing market bubble is caused due to unsustainable home prices. Like any product or service, the price is determined by the relative demand and supply. Several factors can cause a housing market bubble:

- Rising Economic Prosperity

It refers to the phenomenon where the income-to-price ratio of people is increasing, goods and services become more affordable, and people gain more purchasing power.

- Low Mortgage Interest Rates

As mortgage rates decrease, it becomes more convenient for the homebuyer to afford a home, increasing demand and causing prices to rise.

- Wider Mortgage Product Offerings

For a borrower, multiple types of mortgages are available, such as adjustable-rate mortgages (ARM), conventional loans, fixed-rate mortgages, and government-sponsored mortgages. Multiple options make it easier to get a loan.

- Credit Access

As it becomes easier for buyers to get a loan, the demand consistently increases, and home prices rise.

Buyers are getting a little ground… Not much

The Colorado housing market is undergoing a significant shift, with several factors impacting the market’s overall health. While the market may be shifting towards a buyer’s market, it is essential to keep an eye on key indicators and government policies that could affect the market’s future. Understanding what causes a housing market bubble and the factors that impact the real estate housing market can help both buyers and sellers make informed decisions. Ultimately, only time will tell when the Colorado housing market will remain very strong for the foreseeable future.

Dan Skelly is a real estate broker/owner/agent at Orson Hill Realty in Evergreen CO. Dan is also a Realtor in Southwest Florida on Marco Island and Naples Florida

Dan Skelly Real Estate

- 1 Colorado Housing Market Trends and the Possibility of a Crash

- 2 Factors Affecting the Colorado Housing Market

- 3 Will the Colorado Housing Market Crash?

- 4 Factors Affecting the Colorado Housing Market

- 5 Several parameters impact the real estate housing market in Colorado. These factors are broadly categorized into four key segments:

- 6 What Is a Housing Market Bubble?

- 7 What Causes a Housing Market Bubble?

- 8 Buyers are getting a little ground… Not much